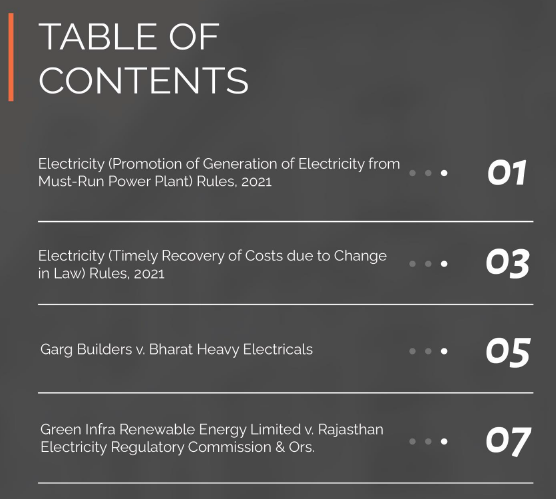

Electricity (Promotion of Generation of Electricity from Must-Run Power Plant) Rules, 2021

(22.10.2021)

INTRODUCTION

On 22.10.2021, the Ministry of Power (MoP) notified the Electricity (Promotion of Generation of Electricity from Must-Run Power Plant) Rules, 2021(Rules) under the powers vested to it within the Electricity Act, 2003 (Act). The Rules have been notified to ensure sustainability of the sector. In a statement issued by the Ministry it was also expressed how this move aims to align the sustainability of the electricity sector and promotion of clean energy with India’s commitment towards climate change.

SALIENT FEATURES

- An Intermediary Procurer has been defined to be an intermediary company, nominated by the Central/State govt., between the licensees and the generating company. The procurer shall be required to either aggregate the purchased electricity from different generators and sell it to the distribution licensee or to enhance the credit profile.

- The intermediary procurer may procure electricity through a transparent process of bidding in accordance with the guidelines issued by the Central Government under Section 63 of the Act for sale to one or more distribution licensees.

- A ‘must-run power plant’ shall be a power plant (wind, solar, wind-solar hybrid or hydro or a power plant from any other sources as may be notified by the Appropriate Government) which has entered into an agreement to sell electricity to any person. It shall not be subjected to curtailment or regulation of generation or supply of electricity on account of merit order or any other commercial consideration.

- In case there is a curtailment of supply from a must-run power plant (on account of grid safety), then compensation shall be payable by the procurer to the must-run power plant at the rates specified in the agreement for purchase or supply of electricity.

- The intermediary procurer, an agency nominated by the Central Government or State Government, may procure electricity through a transparent process of bidding in accordance with the guidelines issued by the Central Government under section 63 of the Act for sale to one or more distribution licensees.

The Rules are in line with the commitment made by Indian Govt. to achieve 175 GW of Renewable Energy (RE) by 2022. Moreover, these Rules come as a sigh of relief for RE Projects, at a time when across the country RE Projects are being subjected to rampant backing down for commercial reasons. With this, a firm policy has been introduced to compensate the RE generators for such curtailments. This, in our view, is a positive step to ensure viability of the sector.”

SKV Opinion

Please find link to Notification here

Electricity (Timely Recovery of Costs due to Change in Law) Rules, 2021

(22.10.2021)

INTRODUCTION

On 22.10.2021 the Ministry of Power (MoP) issued a Notification framing the Electricity (Timely Recovery of Costs due to Change in Law) Rules, 2021 (Rules) under the powers vested to it by the Electricity Act, 2003 (Act). These Rules have been framed to sustain economic viability of the sector, ease financial stress of stakeholders and ensure timely recovery of costs involved in electricity generation. Various concerns were raised by investors and other stakeholders in the power sector regarding the timely recovery of the costs due to change in law, curtailment of renewable power, and other related matters. The Rules have been framed to voice those concerns. MoP also expressed how timely recovery of the costs due to change in law is of utmost importance as the investments in the power sector largely depend upon timely payments.

SALIENT FEATURES

- “Change in Law”, in relation to tariff, has been defined as any enactment, amendment, or repeal of any law made after the determination of tariff under the appropriate law of the Act which leads to a corresponding change in the cost requiring change in tariff and includes:

- A change in interpretation of any law by a competent court.

- A change in any domestic tac, including duty, levy, cess, charge or surcharge by the Centre/State/Union administration leading to a corresponding changes in the cost.

- A change in any condition of an approval or license obtained or to be obtained for purchase, supply or transmission of electricity, unless specifically excluded in the agreement.

- The monthly tariff or charge shall be adjusted and recovered in accordance with these Rules to compensate the affected party in a way to restore its economic position as if such change in law had never occurred.

- The impact of change in law shall be calculated as per the formula provided under the agreement. In case the agreement does not specify a formula, the formula given in the Schedule to the Rules needs to be applied.

This Notification, in our opinion, clarifies the ambiguity surrounding determining the impact in tariff or charges due to a “Change in Law,” and provides a timeline for recovery in the case of a fixed amount, with the recovery taking place within 180 months or until the impact persists (in the case of a recurring impact), as well as a straight jacket formula to determine the impact due to a “Change in Law” if the same is not provided in the Agreement.

Though the said Rules intends on expeditious recovery of change in law claim (by capping recovery within 180 months). The rate of interest at which recovery would take place has been capped. Such capping of rate of interest would be detrimental to the return on equity which ought to have been provided for effecting restitution.”

SKV Opinion

Please find link to Notification here

Garg Builders v. Bharat Heavy Electricals

Arbitrator cannot grant pendente lite interest when parties have expressly opted out of receiving interest in the Contract

(04.10.2021)

INTRODUCTION

The present case was filed as an appeal against the Order dated 10.09.2017 of the Division Bench of the High court of Delhi. In that Order the pendente lite interest on the award amount was denied to Garg Builders. Pendente lite interest means the interest that accrues to the base amount while the pendency of the suit during the arbitration proceeding. As a consequence, Garg Builders filed the present appeal before the Supreme Court of India.

BRIEF FACTS

Garg Builders entered into a contract with Bharat Electricals Ltd. for construction of a boundary wall at power plant of Bharat Electricals. Clause 17 of the contract explicitly stated that Bharat Electricals shall not pay any interest on the earnest money deposit, security deposit, or any monies due to Garg Builders.

Upon dispute arising, the parties appointed a sole arbitrator and commenced arbitration proceedings. The arbitral award provided1za that pendente lite and future interest at the rate of 10% p.a. on the value of the award amount to Garg Builders from the date of filing the claim petition (December, 2011) till the date of realisation of the award amount.

Bharat Electricals challenged this Award before the High Court of Delhi on the ground that the Arbitrator travelled beyond the terms of the contract in awarding pendente lite interest on the Award since the same was expressly barred under the Contract. The Award was set aside by a single bench in the Delhi High Court in 2017 to the extent of award of pendente lite interest. The same was upheld again by the division bench of the High Court.

Aggrieved by both Orders, Garg Builders filed this appeal before the Supreme Court.

RULING

The Supreme Court held that an arbitrator cannot grant pendente lite interest when the contracting parties have freely and expressly opted out of receiving interest under the contract. It stated that according to the Arbitration & Conciliation Act paramount importance must be given to the contract entered into by both parties. Clause 17 of the contract categorically barred the payment of interest on all monies due to Garg Builders.

It was further held, after relying on various judicial precedents, that if a contract expressly barred granting pre-award interest, the arbitrator cannot grant such interest.

Considering the validity of the contract under the Contract Act, the Supreme Court concluded that when there is express statutory permission for parties to contract out of receiving interest, and they have done so without vitiation of free consent, then it is not open for the arbitrator to grant pendente lite interest.

Besides clarifying the issue regarding pendente lite interest, Supreme Court’s judgment has upheld the autonomy of parties, which is the bedrock for any arbitration. The judgment further upholds the principle that the parties are bound by their bargain in a contract.”

SKV Opinion

Please find link to Judgment here

Green Infra Renewable Energy Limited v. Rajasthan Electricity Regulatory Commission & Ors.

(12.10.2021)

INTRODUCTION

The present appeal was filed before the Appellate Tribunal for Electricity (APTEL) against the Order of the Rajasthan Electricity Regulatory Commission (RERC) dated 23.07.2021 wherein the prayer of Green Infra Renewable Energy Ltd. (Green Infra) claiming relief on account of Change in Law and Force Majeure was declined. The APTEL in this Order has held that change in law claims can be considered at the tariff adoption stage in order to reduce multiplicity of proceedings and provide regulatory certainty to developers.

BRIEF FACTS

On 16.07.2020, the Solar Energy Corporation of India (SECI) issued an RfS for selection of Solar Power Developers for setting up of 1070 MW Grid Connected Solar PV Power Projects in Rajasthan (Tranche – III) under the tariff based competitive bidding. On 28.12.2020, Green Infra was declared as the successful bidder and Letter of Award (LOA) for development of 400 MW solar power project, generation, and sale of power under the RfS was issued in its favour. On 04.03.2021, Green Infra and SECI executed the Power Purchase Agreement (PPA).

The Rajasthan Urja Vikas Nigam Ltd. (RUVNL), beneficiary under the PPA, moved the RERC for adoption of tariff for 1070 MW Solar PV Power under Section 63 of the Electricity Act, 2003 impleading Green Infra as one of the Respondents therein. The RERC passed an Order on 23.07.2021, whereby RERC recorded satisfaction that the bid discovered tariff merited acceptance and adoption in as much as the process undertaken was in accord with the guidelines issued by the Central Government, the process undertaken being transparent.

In the run-up to the above Order, on account of increase in basic custom duty on import of solar inverters, levy of basic customs duty on import of solar cells and certain other development upward revision of the discovered tariff was necessitated as these events were in the nature of Change in Law and Force Majeure.

However, RERC declined to grant any relief in above nature and closed the proceedings by the above order leaving the Green Infra to approach it again after adoption of tariff on the tentative view that at the stage of adoption of tariff, the Commission could only examine whether the competitive bidding process under Section 63 of the Electricity Act, 2003 was in accord with the guidelines issued by the Government of India and whether the process was held in a transparent manner. Aggrieved by the said Order, Green Infra filed the Appeal.

RULING

The APTEL agreed with Green Infra that deferring such claim for later date creates a whole lot of confusion and regulatory uncertainty and consequent difficulties in attaining financial closure. It further observed that the impact on cost of development of the project of such change in law events that had occurred after the submission of the bid and closure of the bid process but before the adoption of the bid discovered price renders the bid price unrealistic.

It also held that that it is the duty of the State Commission to inquire into such claims at the first opportune time and bring suitable corrections. Following were the key findings of the APTEL:

(a) There is no prohibition on consideration of change in law at the stage of adoption of tariff under Section 63 of the Electricity Act, 2003.

(b) Change in Law events can render the bid price unrealistic and the State Commission is duty bound to inquire into such claim at the first opportune time and bring about suitable corrections.

(c) The tariff adoption order was inconclusive and inchoate since change in law events had not been considered.

In our opinion, a bid becomes unrealistic when the cost of development of the project changes on account of change in law events after submission of the bids but before the adoption of tariff. Such a difficulty should be cured in the adoption of tariff proceedings, which is the first opportune time for the Commission. Therefore, the APTEL has rightly held that the approach taken by RERC would lead to multiplicity of proceeding and unnecessarily lead to regulatory uncertainty.”

SKV Opinion

Please find link to Judgment here

Contributions by:

- Shivikka Aggarwal

- Ashutosh Srivastava

- Mehak Verma

- Isnain Muzamil