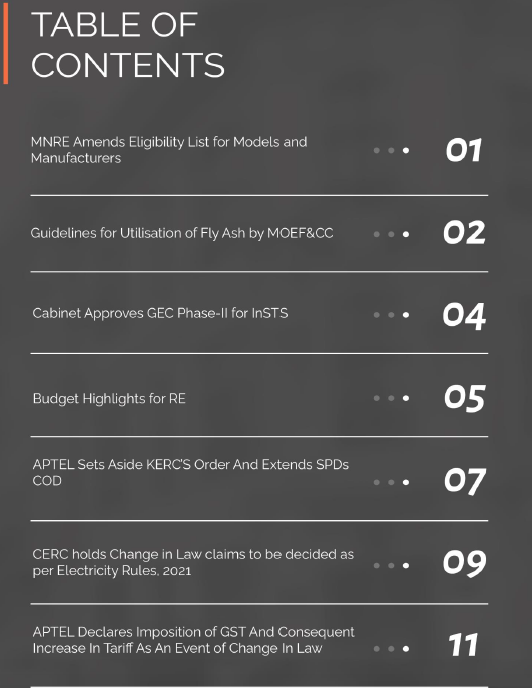

MNRE Amends Eligibility List for Models and Manufacturers

(13.01.2022)

On 02.01.2019, the Ministry of New and Renewable Energy (MNRE) had issued an Office Memorandum (OM) regarding approved Models and Manufacturers of Solar Photovoltaic Modules (Requirements for Compulsory Registration). On 13.01.2022, another amendment was made to the existing provision which read as under:

“Accordingly, the Ministry of New and Renewable Energy (MNRE) has decided to enlist the eligible models and manufacturers of solar PV cells and modules complying with the BIS Standards and publish the same in a list called the “Approved List of Models and Manufacturers” (ALMM). Only the models and manufacturers included in this list will be eligible for use in Government/ Government assisted Projects/ Projects under Government Schemes & Programmes, installed in the country, including Projects set up for sale of electricity to Government under the Guidelines issued by Central Government under section 63 of Electricity Act, 2003 and amendment thereof. The word “Government” shall include Central Government, State Governments, Central Public Sector Enterprises, State Public Sector Enterprises and, Central and State Organisations/ Autonomous bodies.”

The amendment has now included the following in the list under which models and manufacturers in the ‘Approved list’:

-

- Government Projects

- Open Access

- Net Metering Projects

Please find link to OM here

Guidelines for Utilisation of Fly Ash by MOEF&CC

(31.12.2021)

INTRODUCTION

The Ministry of Environment and Forests (MOEF), on 14.09.1999, issued directions discouraging the excavation of topsoil to manufacture bricks and other building materials. Instead, they promoted the use of fly ash to manufacture such building materials within a specified radius.

Considering the difficulties faced by the Generating Companies, the timelines for achieving 100% fly ash utilization by TPPs have now been revised in terms of Clause (4) thereof. The Notification now contemplates a three-year cycle for achieving 100% average utilization in those three years subject to certain conditions (compliance cycle).

Through the Notification, the Central Government has reviewed the existing notification to make it more effectively based on the polluter pays principle (PPP) to ensure 100% utilisation of fly-ash and for the sustainability of fly ash management system.

OBJECTIVES

The following objectives has been listed in the Gazette Notification as steps taken towards the amendment:

- Need to conserve topsoil by promoting manufacture and mandating use of ash-based products and building materials in the construction sector.

- Use fly ash for road laying, road, and flyover embarkments, shoreline protection measures, low lying areas of approved projects, backfilling of mines instead of using earthen materials.

- Necessary to protect environment from fly-ash dumping discharged from coal or lignite based thermal power plants on land.

- ‘Ash’ shall include both fly ash, as well as bottom ash generated from coal or lignite based thermal power plants (TPP).

- Need for a comprehensive framework for ash utilisation including system of environmental compensation based on PPP.

FEATURES

Responsibilities of Thermal Power Plants:

- TPPs shall now be responsible to utilize 100% ash (fly & bottom ash) generated during that year and utilization shall not fall below 80%.

- TPPs shall achieve average ash utilization of 100% in a 3-year cycle where ash utilization is 80% or more.

- In case the utilization is between 60-80%, the 3-year cycle is extendable by 1 year; and in case the utilization is less than 60%, it is extendable by 2 years.

- Eco-friendly purposes to include:

- Fly-ash based products for building/construction material

- Content manufacturing, ready mix concrete

- Construction of road, flyover embarkment, ash and geo-polymer-based construction material

- Construction of dam

- Filling up of low-lying area

- Filling of mine voids

- Manufacturing of sintered or cold bonded ash aggregate

- Agriculture in controlled manner based on soil testing

- Construction of shoreline protection structures in coastal districts

- Export of ash to other countries

- Any other purposes that may notified from time-to-time

- Committee shall be constituted under the chairmanship of Chairman, CPCB and members from the MOEF&CC and other related ministries to examine and review eco-friendly ways of utilisation of fly-ash and make inclusion or exclusion or modification in the given list accordingly.

- In no case shall the utilisation of fly ash fall below 80% in any years and an average of 100% utilisation shall be achieved in a three-year cycle by TPP.

- The unutilised ash shall be stored before the MOEF&CC shall be utilised progressively by TPPs in such a manner that the utilisation of legacy ash shall be completed fully within 10 years from the date of publication of this notification.

- Any new or existing TPP shall be permitted an emergency or temporary ash pond with an area of 0.1 hectare per megawatt (MW).

- Every coal or lignite based TPP shall dedicate silos for storage of dry fly ash silos for at least 16 hours of ash based on installed capacity and it should be reported to the concerned State Pollution Control Board (SPCB) or Pollution Control Committee (PCC) which shall be inspected by the Central Pollution Control Board (CPCB)/ SPCB/PCC from time to time.

Please find link to Gazette Notification here

Cabinet Approves GEC Phase-II for InSTS

(06.01.2022)

INTRODUCTION

The Green Energy Corridor (GEC) Phase-II for Intra-State Transmission System (InSTS) (Scheme) was approved on 06.01.2022 by the Cabinet Committee on Economic Affairs, chaired by Prime Minister Shri Narendra Modi. Under the approval an addition of approximately 10,750 circuit kms (ckm) of transmission lines and approx. 27,500 mega volt-amperes (MVA) transformation capacity of substations shall be granted. Power evacuation of around 20 GW of Renewable Energy (RE) shall be facilitated under the Scheme along with grid integration in 7 states, being:

- Gujarat

- Himachal Pradesh

- Karnataka

- Kerala

- Rajasthan

- Tamil Nadu

- Uttar Pradesh

OBJECTIVES

The total estimated cost of the scheme is expected at INR 12,031.33 crore and Central Financial Assistance (CFA) @ 33% of the project cost i.e., INR 3970.34 crore. A period of 5 years is required for the transmission systems to be created from FY 2021-22 to 2025-26. CFA is to ensure the power costs remain down as an effort to offsetting Intra-State transmission charges. It is expected for the Scheme to help achieve the target of 450 GW installed RE capacity by 2030.

The Scheme has been formulated with the objective of contributing to the long-term energy security of the country and promote ecologically sustainable growth by reducing carbon footprint. Both, direct and indirect employment opportunities are expected to arise out of this Scheme for skilled and unskilled personnel in power and other related sectors.

GEC-Phase-I is already under implementation in the states of Andhra Pradesh, Gujarat, Himachal Pradesh, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan and Tamil Nadu for grid integration and power evacuation of approx. 24 GW of RE power project which is expected to be completed by 2022. This Scheme introduces an addition of 9700 ckm of transmission lines and 22600 MVA capacity of substations with an estimated cost of INR 10,141.69 crore with CFA of INR 405.67 crore.

Please find link to Press Release here

Budget Highlights for RE

The Ministry of New and Renewable Energy (MNRE) has issued highlights for the 2021-22 Budget. They are listed as below:

- In order to promote the integration of Indian manufacturing companies in global supply chains, core competence and cutting- edge technology, Production Linked Incentive Scheme (PLI) has been announced for 13 sectors under the new Budget. The government has committed approx. INR 1.97 lakh crores over a period of 5 years starting from FY 2021-22. This step is taken with the objective to help bring scale and size and key sectors, create, and nurture global champions and provide jobs to the youth.

- Under the PLI scheme 10000 MW capacity of integrated solar PV manufacturing plants shall be set up by Q4 of 2022-23 with direct investments of around INR 14000 crores.

- A direct employment will be created for approx. 30,000 persons in manufacturing activity and 1,20,000 people will be engaged in indirect employment in areas like ancillary, and allied industrial activities, packaging, logistics, and other services.

- Additional manufacturing capacity of 10000 MW high efficiency domestic solar PC module capacity every year shall result in import substitution of such quantity, thereby leading to savings in foreign exchange of INR 17500 crores annually.

- New technology shall be used such a crystalline silicon, thin film, or any new materials such as TOPCon, Heterojunction, silicon with tandem cell ,thin film with tandem cell, Perovskite, Perovskite with tandem cell etc.

- The beneficiaries of PLI Scheme shall be selected through a transparent bidding process. Preference shall be given to those manufacturers who will set up integrated solar PV manufacturing plant of higher capacity. The minimum performance parameters relating to efficiency of solar PV modules must be fulfilled by the bidding manufacturer.

- In November 2020 the PM, at the 3rd RE-Invest Conference announced plans to a launch a comprehensive National Hydrogen Energy Mission in 2021-22 for generating hydrogen from green power sources. This initiative aims to lay down the Government’s vision, intent and direction for hydrogen energy and suggest strategy and approaches for realising the vision.

- To boost the energy sector an additional capital infusion of INR 1000 crores to Solar Energy Corporation of India and INR 1500 crores to Indian Renewable Energy Development Agency has been proposed in the new Budget. The Government of India has proposed an equity infusion on INR 1000 crore in Solar Energy Corporation of India Limited (SECI). This infusion will enable SECI to 15,000 MW of tenders on an annual basis. It will also attract investment of more than INR 60,000 crores, generate 45,000 jobs and reduce emissions of 28.5 million tons of carbon dioxide per year.

- A capital infusion of INR 1000 crores to SECI and INR 1500 crores to Indian Renewable Energy Development Agency (IREDA) shall be made to boost the sector. With this, IREDA will be able to extend additional loan facility of INR 12000 crores as an addition to the already existing INR 27000 crores. The additional capital is aimed to improve the capital adequacy of IREDA in borrowing at a lower rate of interest and thus lower the interest rates for developers. It will also help finance 4500 MW of RE projects worth INR 18000 – 19000 crores, generate 13,500 jobs yearly and reduce emissions of 8.55 million tons of carbon dioxide.

Please find link to Highlights here

APTEL SETS ASIDE KERC’S ORDER AND EXTENDS SPDs COD

(06.01.2022)

INTRODUCTION

The Appellate Tribunal for Electricity (APTEL), vide its judgment dated 06.01.2022 titled as ‘Vatsala Ballary Solar Projects Private Limited v. Karnataka Electricity Regulatory Commission & Anr’ allowed the Appeal filed by a Solar power Project Developer (SPD) challenging Order dated 10.07.2018 (Impugned Order) passed by the Karnataka Electricity Regulatory Commission (KERC).

BRIEF FACTS

Solar Power Project set up by the SPD was pursuant to a scheme floated by the State Government for land owning farmers encouraging them to establish certain projects.

The project achieved Commercial Operation Date (COD) on 02.07.2017 with a delay of 6 months on account of approval for conversion of the land, the matter having taken about 10 months at the level of the government agencies which is covered under Article 8 of the Power Purchase Agreement (PPA) pertaining to Force Majeure. A three-member committee was set up by the Government of Karnataka (GoK) which agreed that the delays occurred at the behest of the Government departments.

Bangalore Electricity Supply Company Limited (BESCOM) agreed for an extension requested by the SPD vide its letter dated 02.03.2017. However, the Karnataka Electricity Regulatory Commission (KERC) vide its general order dated 16.03.2017 directed that no extension of such nature would be granted without prior approval by the State Commission.

Further, the BESCOM Board of Directors while having approved the extension of six months as communicated to the SPD on 02.03.2017, it added a pre-condition that the same would now be subject to the approval by KERC.

In the view of the above, BESCOM declined to pay the agreed tariff stating that the contracted rate cannot be enforced without the approval of extension by KERC.

Further, an Original Petition was filed before KERC wherein vide the Impugned Order dated 10.07.2018, observed that there was in fact a 7month delay on the part of SPD in applying for conversion and accordingly while granting approval, it reduced the tariff which had been agreed between the parties.

RULING

APTEL vide its Judgment, and while placing strong reliance on the a matter which was decided by APTEL on 14.09.2020 (the case of Chennamangathihalli), allowed the appeal filed by the SPD observing as follows:

- The instant case is covered by the ruling in the case of Chennamangathihalli and the broad principle followed there are applicable to the present case wherein the reduction of tariff was rejected. This decision was assailed by BESCOM and was later on dismissed by the Supreme Court vide its Order dated 18.12.2020 in Civil Appeal No. 3958 of 2020.

- The relevant clauses of PPA conferred discretion on the parties to amicably resolve issues as of delay in achieving CoD. BESCOM had the discretion to agree or not to agree to the request for extension.

- The subsequent decision, promulgated by a general Order dated 16.03.2017 passed by KERC cannot take away the effect and import of the agreement that had already been achieved on 02.03.2017 when BESCOM communicated its consent for extension by 6 months.

- The condition added by the Board of Directors of BESCOM on 16.05.2017 is incorrect.

- KERC has fallen into error by embarking on an inquiry into the reasons for delay so as to deny the benefit of extension agreed upon by the parties in accordance with contractual provisions and also the contractual rate of purchase of electricity by BESCOM.

- The delay stands condoned post the communication of the decision by the BESCOM by letter dated 02.03.2017, and in that view, BESCOM is bound to honour its obligation as to the agreed financial terms under the PPA.

- It is the contractual obligation of BESCOM to make good the deficiency in payments for the period up to the date of this judgment.

In our opinion, APTEL has rightly observed that in case there is a delay in commissioning of a project, the parties are expected to act in terms of the contract entered into by the parties. Further, the State Commissions must observe the categorical terms of the PPA and should not take decisions dehors the understanding of the parties as penned down in a contract.”

SKV Opinion

Please find the link to Judgment here

CERC holds Change in Law claims to be decided as per Electricity Rules, 2021

(19.01.2022)

INTRODUCTION

The Central Electricity Regulatory Commission (CERC) in a Petition filed by Jindal Power Limited under Section 79(1)(b) and (1)(f) of the Electricity Act, 2003 (Act) read with Article 10 of the Power Purchase Agreement (PPA) dated 29.06.2012 and 23.08.2013 executed with TANGEDCO for 200 MW Medium Term Power Supply and 400 MW Long Term Supply respectively declared the Notification dated 19.12.2017 issued by Coal India Limited (Change in Law Notification) as a change in law event. The Petition was filed by Jindal Power Limited seeking as follows:

- Declare Change in Law Notification dated 19.12.2017 issued by Coal India Limited as a Change in Law event as per provisions of the PPA.

- Direct TANGEDCO to make payment of Rs 3421.06 Lakh to Jindal Power Limited towards additional expenditure incurred till 31.03.2020.

BRIEF FACTS

On 29.06.2012 and 23.08.2013, Jindal Power Limited and TANGECO entered upon Power Purchase Agreements for Medium- and Long-Term Supply of Power.

On 19.12.2017, Coal India Limited by way of Notification introduced Evacuation Facility Charges @ Rs 50/MT of coal.

In view of the Notification declared by Coal India Limited, Jindal Power Limited filed Petition No. 700/MP/2020 before CERC with prayer to declare Notification as Change in Law event.

While the proceedings were pending, on 22.10.2021, Ministry of Power (MoP), Government of India (GoI) in exercise of power conferred by sub-section(1), read with clause (z) of sub-section(2) of Section 176 of the Act notified the Electricity Rules, 2021 thereby providing a mechanism by way of which the parties to PPA will settle the claims against the Change in Law event amongst themselves in terms of the procedure prescribed under Rule 3 of the Rules.

RULING

CERC while considering the Electricity Rules, 2021 notified by MoP, GoI held that on occurrence of Change in Law event, the affected party in terms of Rule 3 are to settle the Change in Law claims amongst themselves and thereafter, approach the Appropriate Commission only in terms of Rule 3(8) of Electricity Rules.

The argument of counsel for Jindal Power Limited that as the Petition was reserved, therefore, the new mechanism for settlement in terms of Electricity Rules, 2021 is not applicable to the instant case was rejected by CERC as:

- Electricity Rules, 2021 provides a time bound mechanism for settlement of claims, therefore, no prejudice would be caused to Jindal Power Limited of the mechanism envisaged under Rule 3 is adopted.

- While placing its reliance upon previous orders, CERC held that Electricity Rules are in nature of procedural law and no substantiative rights are being taken away, therefore, the Electricity Rules will be applied retrospectively.

While the Electricity Rules, 2021 provides for time-bound mechanism for settlement of claims under the PPA, however, the retrospective application of the Electricity Rules, 2021 would substantially delay in adjudicating the Claims of the Generating Companies which have already approached the Appropriate Commission under the varies of the Act.

Therefore, the retrospective application of the Electricity Rules, 2021 would defeat its objective of settling the claims of the parties in time bound manner as the affected party under the PPA would still have to approach the Appropriate Commission for Change in Law reliefs in the event the parties does not arrive at a settlement in terms of Rule 3 of the Electricity Rules, 2021.”

SKV Opinion

Please find the link to Order here

APTEL DECLARES IMPOSITION OF GST AND CONSEQUENT INCREASE IN TARIFF AS AN EVENT OF CHANGE IN LAW

(13.01.2022)

INTRODUCTION

The Appellant i.e., Azure Power Eris Private Limited (Azure), in the present Appeal filed before the Appellate Tribunal for Electricity (APTEL) assailed the Bihar Electricity Regulatory Commission’s (BERC) Order dated 07.12.2019 (Impugned Order) whereby BERC disallowed it to claim the benefit of the increase in tariff on account of change in law, inter alia, being the Finance Act, 2015, Finance Act, 2016; and the Integrated Goods and Service Tax Act, 2017 and the Bihar Goods and Service Tax Act, 2017 (GST Laws).

BRIEF FACTS:

Vide the Impugned Order, BERC even after accepting that GST Laws do constitute as change in law within the meaning of ‘change in law’ provision under the Power Purchase Agreement (PPA), disallowed the claim for benefit of the increase in tariff by creating an exception that the Operation and Maintenance work had been outsourced by the Appellant.

Before APTEL, Azure relied upon the decision of the Tribunal in Coastal Gujarat Power Limited v. Central Electricity Regulatory Commission, Appeal No. 172 of 2017, wherein it was held that the terms of the PPA binds the parties and it is not open for any adjudicating forum to substitute its own view. In the same decision, APTEL also held that if the levy of tax on services availed by a power producer has an impact on the cost or the revenue from generation and sale of electricity, whether directly or indirectly, compensation must follow.

However, it was conceded by both parties that it would be fair to remit the matter to the BERC for fresh consideration.

RULING:

APTEL in view of the aforementioned submissions, set aside the Impugned Order and remitted the same for fresh consideration of BERC, without being bound by the Tribunal’s Order.

In our opinion, APTEL has rightly placed reliance on the Judgment passed in Coastal Gujarat Power Limited (supra). Further, APTEL was judicious in its approach in remanding the matter to the State Commission, to decide the issue as the Judgment of Coastal Gujarat Power Limited (Supra) was delivered subsequent to the order of BERC.”

SKV Opinion

Please find the link to Judgment here

Contributions by:

- Shivikka Aggarwal

- Suhael Buttan

- Siddharth Joshi

- Ashutosh Srivastava

- Tushar Srivastava

- Mehak Verma

- Jayant Bajaj